myCGS Part B Automated Reopenings: Form RMF 780

Form RMF 780![]() (Reopenings Modifier Adjustment Request Form) will allow you to request simple corrections specific to adding, replacing, or deleting a modifier on a line item of a previously processed claim.

(Reopenings Modifier Adjustment Request Form) will allow you to request simple corrections specific to adding, replacing, or deleting a modifier on a line item of a previously processed claim.

Only one claim can be corrected per form; up to 12 line items per claim.

NOTE: In order to complete the form accurately, you must have access to your Remittance Advice (RA). If you download your RA from a billing service or clearinghouse, the line items may be in a different sequence, which will affect the processing on this form. We suggest accessing your RA directly from the myCGS® Web Portal.

Also, to avoid issues with legibility, we encourage you to complete the form online, and then print it.

Automated Reopenings Modifier Adjustment Request Form Instructions

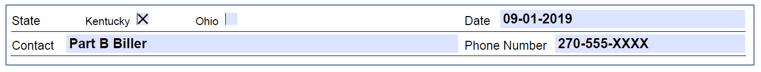

- Complete the Header of the form:

- Select the State

- Enter the date the form is completed

- Enter a contact person's name and telephone number

- NOTE: This information is important should we need to contact you with a question regarding your Reopening request.

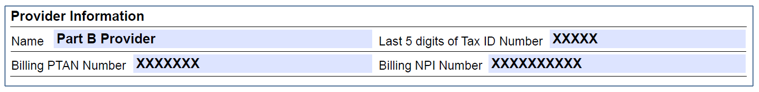

- Complete the Provider Information section:

- Identify the last 5 digits of Tax ID number

- Enter the Billing PTAN

- Individual physicians/practitioners who reassign benefits to a group, enter the Group PTAN.

- Solo physicians/practitioners, enter the Individual PTAN.

- Enter the Billing NPI

- Individual physicians/practitioners who reassign benefits to a group, enter the Group NPI.

- Solo physicians/practitioners, enter the Individual NPI.

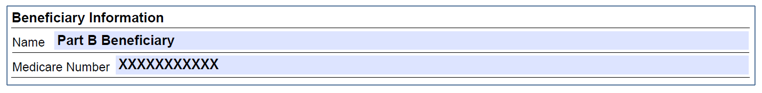

- Complete the Beneficiary Information section:

- Enter the Beneficiary's Name

- Enter the Beneficiary's Medicare ID

- To avoid processing delays, please verify that the Medicare ID is correct.

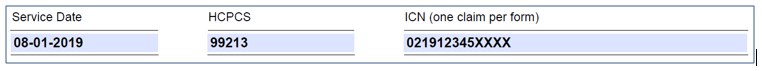

- Identify the claim information:

- Enter a Date of Service from the claim.

- Identify a HCPCS/CPT code (procedure code) that corresponds to the date of service.

- Enter the Internal Control Number (ICN) of the claim, which is located on the RA.

- Verify that the ICN is accurate. Incorrect, incomplete, or invalid ICNs will result in increased processing time (up to 60 days).

- Complete each column of the Adjustment Details section using information from the RA:

- Identify the Line you wish to have corrected.

- For example, if the RA shows the claim was submitted with nine line items, and the correction is needed on line six of the claim, enter '6'. (A value of 1-13 may be entered in this field.)

- Identify the Position of the modifier on the claim.

- For example, if the RA shows two modifiers were submitted on the service, and the correction is needed to the second modifier, enter '2'. (A value of 1-4 may be entered in this field.)

- Enter the modifier Adjustment Type by entering the corresponding alpha character. The options are:

- A – Add a modifier to the line and position identified in the previous columns.

- NOTE: If the current modifier position is already filled with a modifier which is required for the claim and you use the ADD, the new modifier will replace/remove that modifier. Make sure to add new modifiers to the NEXT open position.

- R – Replace a modifier on the line and position identified in the previous columns

- D – Remove the modifier from the line and position identified in the previous columns

- A – Add a modifier to the line and position identified in the previous columns.

- Identify the New Value (modifier)

- This field is required when selecting Adjustment Type of A or R only. Enter the new two-character modifier.

- This column is to remain BLANK if the 'D' (Remove) option is selected in the previous column.

- Identify the Line you wish to have corrected.

Please note the following:

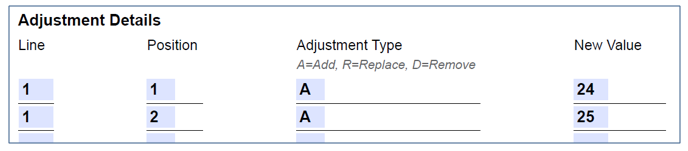

- You may make only ONE correction per line. If two modifiers need to be added to a claim line, complete two rows of the form.

- For example, to add CPT modifiers 24 and 25 to an Evaluation and Management (E/M) service, complete the Adjustment Details section as follows:

- For example, to add CPT modifiers 24 and 25 to an Evaluation and Management (E/M) service, complete the Adjustment Details section as follows:

Please pay special attention to the Adjustment Details section. Forms submitted with inaccurate, incomplete, or missing Line and Position fields may result in increased processing time of up to 60 days.