AUTOMATED REOPENINGS:

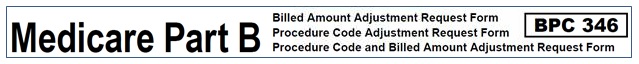

Form BPC 346![]() (Billed Amount, Procedure Code, Procedure Code/Billed Amount Combined Adjustment Request Form) will allow you to add or replace the billed amount, procedure code, or both the billed amount AND procedure code to the line items of a previously processed claim.

(Billed Amount, Procedure Code, Procedure Code/Billed Amount Combined Adjustment Request Form) will allow you to add or replace the billed amount, procedure code, or both the billed amount AND procedure code to the line items of a previously processed claim.

Only one claim can be corrected per form; up to 12 line items per claim.

NOTE: In order to complete the form accurately, you must have access to your Remittance Advice (RA). If you download your RA from a billing service or clearinghouse, the line items may be in a different sequence, which will affect the processing on this form. We suggest accessing your RA directly from the myCGS® Web Portal.

Also, to avoid issues with legibility, we encourage you to complete the form online, and then print it.

Automated Reopenings Billed Amount, Procedure Code, Procedure Code and Billed Amount Adjustment Request Form Instructions

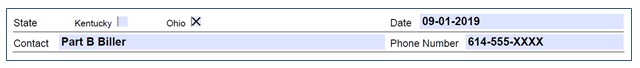

- Complete the Header of the form:

- Select the State

- Enter the date the form is completed

- Enter a contact person's name and telephone number

- NOTE: This information is important should we need to contact you with a question regarding your Reopening request.

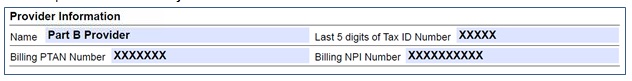

- Complete the Provider Information section:

- Identify the last 5 digits of Tax ID number

- Enter the Billing PTAN

- Individual physicians/practitioners who reassign benefits to a group, enter the Group PTAN.

- Solo physicians/practitioners, enter the Individual PTAN.

- Enter the Billing NPI

- Individual physicians/practitioners who reassign benefits to a group, enter the Group NPI.

- Solo physicians/practitioners, enter the Individual NPI.

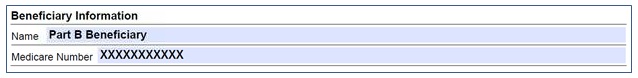

- Complete the Beneficiary Information section:

- Enter the Beneficiary's Name

- Enter the Beneficiary's Medicare ID

- To avoid processing delays, please verify that the Medicare ID is correct.

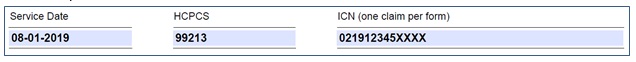

- Identify the claim information:

- Enter a Date of Service from the claim.

- Identify a HCPCS/CPT code (procedure code) that corresponds to the date of service.

- Enter the Internal Control Number (ICN) of the claim, which is located on the RA.

- Verify that the ICN is accurate. Incorrect, incomplete, or invalid ICNs will result in increased processing time (up to 60 days).

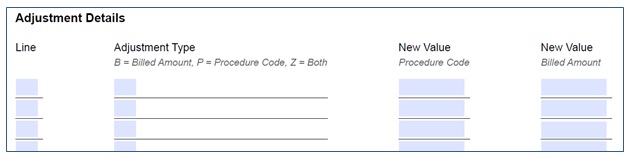

- Complete each column of the Adjustment Details section using information from the RA:

- Identify the Line you wish to have corrected.

- For example, if the RA shows the claim was submitted with nine line items, and the correction is needed on line six of the claim, enter '6'. (A value of 1-13 may be entered in this field.)

- Identify the Adjustment Type by entering the corresponding alpha character.

- B - Billed Amount correction only

- P - Procedure Code correction only

- Z - Billed Amount and Procedure Code (both) correction

- Identify the New Value (Procedure Code) if applicable. This field is required when selecting Adjustment Type of P or Z only. Enter the new, updated five-character procedure code.

- Modifiers cannot be updated or added using this form. This form is for procedure codes and billed amounts only. If a modifier correction is required as well as a procedure code change, the Reopenings Adjustment Request Form (GRF 679) must be used.

- Identify the New Value (Billed Amount) if applicable. This field will be used when selecting the Adjustment Type of B or Z only. Enter the billed amount in the XXXXX.XX format.

- Identify the Line you wish to have corrected.

Please note the following:

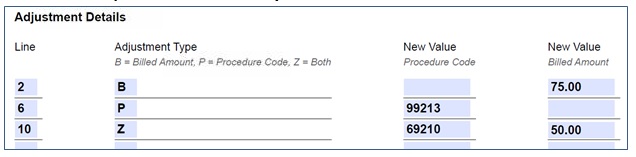

- For the Adjustment Type column:

- Type 'Z' must have information in both the New Value (Procedure Code) and New Value (Billed Amount) fields.

- Type 'B' must have information entered in the New Value (Billed Amount) field only.

- Type 'P' must have information entered in the New Value (Procedure Code) field only.

- For example, to update the billed amount on one line, the procedure code on another line, and both the procedure code and the billed amount on a third line, complete the Adjustment Details section as follows:

- For example, to update the billed amount on one line, the procedure code on another line, and both the procedure code and the billed amount on a third line, complete the Adjustment Details section as follows:

Please pay special attention to the Adjustment Details section. Forms submitted with inaccurate, incomplete, or missing Line and/or New Values may result in increased processing time of up to 60 days.