Submitting Medicare Secondary Payer (MSP) Claims and Adjustments

When your dates of service fall within the Effective and Termination dates of an MSP record, the claims must acknowledge the MSP record by reporting appropriate MSP coding on your claim.

MSP claims are submitted using the ANSI ASC X12N 837 format, or by entering the claim directly into the Fiscal Intermediary Standard System (FISS) via Direct Data Entry (DDE). If you need access to FISS in order to enter claims/adjustments via FISS DDE, contact the CGS EDI department at 1.877.299.4500 (select Option 2).

Submitting MSP Claims via FISS DDE or 5010

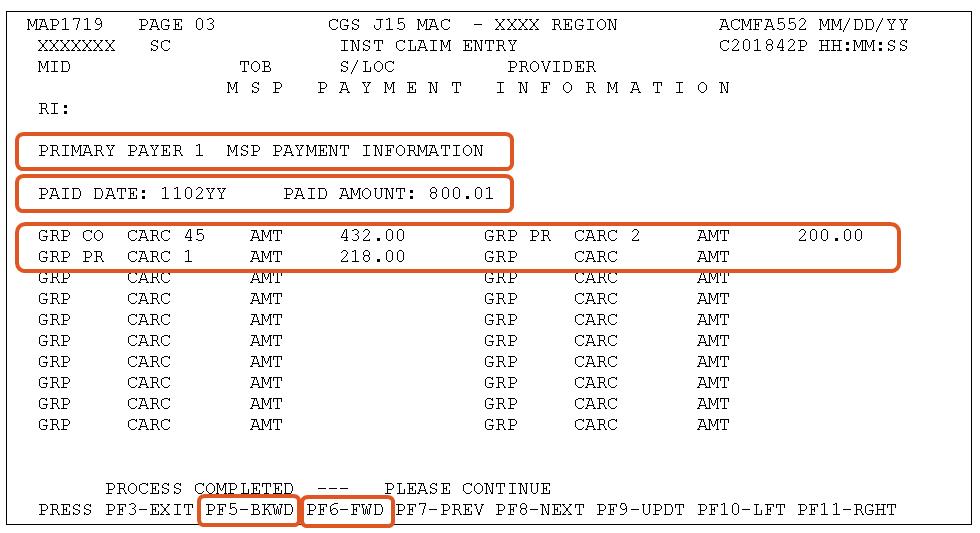

All MSP claims submitted via FISS DDE or 5010 must report claim adjustment segment (CAS) information. In FISS DDE, the CAS information is entered on the "MSP Payment Information" screen (MAP1719), which is accessed from Claim Page 03 by pressing F11. This is in addition to the normal MSP coding information. CAS information on MSP claims submitted via 5010 format is reported in Loops 2320 – 2330I. Refer to the table below for additional information.

The CAS information associated with the primary payer's claim determination is found on the primary payer's 835 remittance advice. This information is entered on the "MSP Payment Information" screen, which accommodates up to 20 entries for primary payer 1, and 20 entries for primary payer 2 (if there is one).

For detailed instructions on reporting other MSP required data elements (value codes, occurrence codes, primary insurer information, etc.) refer to the CGS 'Medicare Secondary Payer (MSP) Billing and Adjustments'![]() quick resource tool or the 'Medicare Secondary Payer (MSP) Billing and Adjustments' Online tool.

quick resource tool or the 'Medicare Secondary Payer (MSP) Billing and Adjustments' Online tool.

FISS MAP1719 - MSP Payment Information Screen |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Field Name |

Description |

5010 Format |

||||||||||

PAID DATE |

Enter the paid date shown on the primary payer's remittance advice. |

|

||||||||||

PAID AMOUNT |

Enter the paid amount shown on the primary payer's remittance advice. This amount must equal the dollar amount entered for MSP Value Code 12, 13, 14, 15, 41, 43 or 47. |

|

||||||||||

GRP |

Enter the Group Code shown on the primary payer's remittance advice. CO - Contractual Obligation Note: If CARC code 45 is entered, the Group code must be “CO” (contractual obligation) or “PR” (patient responsibility). |

|

||||||||||

CARC |

Enter the Claim Adjustment Reason Code (CARC) shown on the primary payer's remittance advice. If CARC code 45 is entered, the Group code must be “CO” (contractual obligation) or “PR” (patient responsibility). Note: CARC codes explain why there is a difference between the total billed amount and the paid amount. The word 'adjustment' in relation to a CARC code is not the same as a "claim" adjustment (type of bill 327 or 817) For a current list of valid CARC codes, refer to the Washington Publishing Company website You can also search through a list of CARC codes by accessing the FISS DDE Inquiry screen option 68 (ANSI REASON CODES) and type "C" in the RECORD TYPE field. |

|

||||||||||

AMT |

Enter the dollar amount associated with the group code (GRP) and CARC. NOTE: If VC 44 (obligated to accept as payment in full) is submitted, the AMT field for GRP ‘CO’ and CARC ‘45’ should equal the difference between the total billed and the VC 44 amount. Using the example below, the VC 44 amount was $1433.00. The total amount entered in the PAID AMOUNT field, plus the adjusted amount(s) entered in the AMT field for each GRP and CARC combination, must equal the total submitted charges on the claim. The screen print example below indicates:

The total amount billed (revenue code 0001) was $1650.01

|

|

||||||||||

Press F6 to access the "MSP Payment Information" screen for primary payer 2 (if there is one).

Press F5 to move back to the primary payer 1 "MSP Payment Information" screen.

Additional Information

- Paper (UB-04) claims can only be submitted to CGS for Black Lung related services, or when a provider meets the small provider exception, (CMS Pub. 100-04, Ch. 24

§90).

§90). - When a beneficiary is entitled to benefits under the Federal Black Lung (BL) Program, and services provided are related to BL, a paper (UB-04) claim must be submitted with MSP coding and the denial notice from the Federal BL Program. If applicable, also provide the workers' compensation insurer denial notice. If the services provided are not related to BL and does not include a BL related diagnosis code, the claim can be submitted via 5010 or FISS DDE showing Medicare as the primary payer.

- When submitting non-group Health Plan (no fault, liability, worker's compensation) claims for services unrelated to the MSP situation, and no related diagnosis codes are reported, do not include any MSP coding on the claim.

Correcting MSP Claims and Adjustments

Return to Provider (RTP): MSP claims may be corrected out of the RTP file (status/location T B9997). However, providers must ensure that claim adjustment segment (CAS) information is reported on the "MSP Payment Information" screen (MAP1719), accessed from Claim Page 03 by pressing F11.

Adjustments: Providers may submit adjustments to MSP claims via 5010 or FISS DDE. However, if using FISS DDE, as with claims in RTP, providers must ensure the MSP information is entered on the "MSP Payment Information" screen. Refer to the Adjustments/Cancels Web page for more information about submitting adjustments.

References

- Change Request 8486

- Instructions on Using the Claim Adjustment Segment (CAS) for Medicare Secondary Payer (MSP) Part A CMS-1450 Paper Claims, Direct Data Entry (DDE), and 837 Institutional Claims Transactions

- Instructions on Using the Claim Adjustment Segment (CAS) for Medicare Secondary Payer (MSP) Part A CMS-1450 Paper Claims, Direct Data Entry (DDE), and 837 Institutional Claims Transactions - CMS Medicare Secondary Payer Manual (Pub. 100-05) Ch. 5 §40.7.3.2

Updated: 12.17.20